MANTRAYA SPECIAL REPORT#07: 10 OCTOBER 2016

Why Kazakhstan learns from Singapore

–

Boh Ze Kai

–

Abstract

Kazakhstan’s adoption of the Singaporean governance and economic model is a fascinating subject worth exploration. Focusing on the Samruk-Kazyna National Welfare Fund, the civil service structure, and healthcare services in Kazakhstan, this article delves into examining how the Kazakh government has attempted to reform its economy and bureaucracy to build a highly functional state.

–

Singapore and Kazakhstan may have little in common. Singapore is the 19th smallest country in the world – a tiny, yet densely-populated English-speaking island with one of the world’s highest GDP per capita, and a developed economy based on maritime shipping routes, financial services, knowledge economy, and high-tech manufacturing of semi-finished value-added goods. Kazakhstan is the 9th largest country in the world – a sparsely-populated, landlocked Russian-speaking expanse of steppes, with an economy based on fortuitous reserves of crude oil and petroleum gas (60 percent of GDP) and large reserves of ores and rare minerals (22 percent of GDP), while wheat-centred agriculture and a small manufacturing industry account for the remainder.

Singapore, not known to many, however, has served a model for Kazakhstan’s economic development since May 1991, when the legendary then-Senior Minister Lee Kuan Yew visited Almaty and delivered a lecture to the economists of the Council of Ministers. Mr Lee convinced President Nursultan Nazarbayev of the importance of adopting a suite of long-term economic policies intended to drive the nascent state into the modern capitalist world economy. In his book ‘The Kazakhstan Way’, Nazarbayev names Lee Kuan Yew alongside Charles de Gaulle as the two greatest statesmen in history (Nazarbayev, The Kazakhstan Way, 2006). On the occasion of the 20th anniversary of Kazakh-Singaporean relations, the Ambassador to Singapore laid out a series of Kazakh policies influenced by the city state (Baudarbek-Kozhatayev, 2013). Much of these policies are pursued as part of Strategy Kazakhstan 2050, a wide-ranging effort put into force in 2011 to modernise and professionalise national institutions across the country.

This article aims to explore recent development policies pursued by Kazakhstan, how they were influenced by Singaporean policies, and comment on their efficacy and differences. In particular, the article focuses on the Samruk-Kazyna National Welfare Fund, the civil service structure, and healthcare services in Kazakhstan.

Samruk-Kazyna National Welfare Fund & Temasek Holdings

In 1974, Temasek Holdings was incorporated under the Singapore Companies Act, with the intention of allowing it to manage assets previously owned by the Government of Singapore. Temasek has never been a government agency or a statutory board, but functions like a normal company with directors, shareholders, management, and fiduciary and tax obligations, albeit with Presidential safeguards and only one shareholder: the Ministry of Finance. The firm initially acquired a portfolio comprising some of Singapore’s largest state-affiliated companies across a wide swathe of industries, household names like Singapore Airlines, the Development Bank of Singapore, Keppel Corporation, and ST Engineering. It later acquired extensive equity investments worldwide, including Alibaba, Paypal, Dell, and the Industrial and Commercial Bank of China. Beginning with an initial portfolio value of S$354 million, the company is now worth S$242 billion with a revenue of S$101 billion (24 percent of Singapore’s GDP for 2016), and six percent 10-year annual returns (Temasek Holdings, 2016).

In 2008, the Samruk-Kazyna National Welfare Fund was formed by Presidential decree, merging the Samruk and Kazyna funds in order to provide long-term maximisation of value in national assets. Modelled after Temasek, its sole shareholder is the Government of Kazakhstan, and its initial holdings were state-owned companies in key industries like national carrier Air Astana, state oil and gas company KazMunayGas and state uranium company Kazatomprom. The company boasted a revenue of 3,091 billion KZT in 2015 (23 percent of Kazakhstan’s GDP), and received acclaim for its role in stabilising the effects of the 2008-2009 recession by acquiring three of Kazakhstan’s worst-hit banks (BTA, TemirBank, Alliance) and providing them with the necessary credit to survive the recession. Samruk-Kazyna’s restructuring of BTA’s US$9 billion external debt into US$650 million was also lauded by the international community.

–

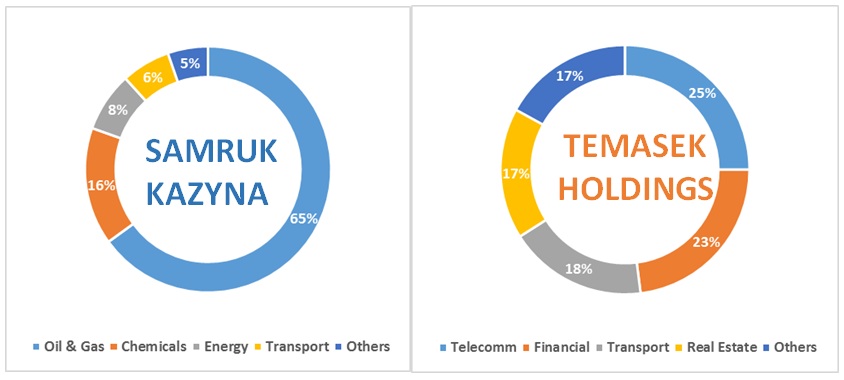

Figure 1: Percentage breakdown of portfolios of Temasek Holdings & Samruk-Kazyna, 2015

–

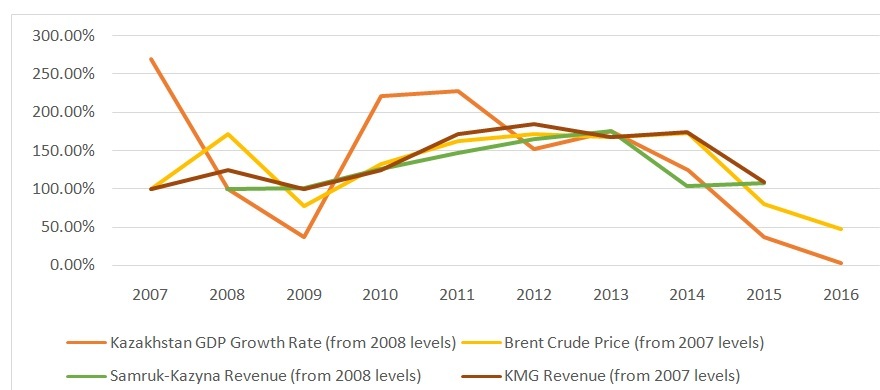

Unlike Temasek, Samruk-Kazyna has mostly committed to developing national assets rather than investing in international acquisitions. Temasek’s portfolio is notably centred around telecommunications, financial services, logistics, and real estate; while Samruk-Kazyna’s portfolio strongly features oil, transportation, energy, and chemicals (see Figure 1).This has left it vulnerable to Kazakhstan’s domestic economic issues, particularly the falling price of oil. Kazakhstan’s national budget for 2015, originally accounting for the price of oil at US$80 a barrel, was revised in January 2015 to account for the price of oil at US$50 a barrel(Urazova D. , 2015), as of 2016, it is now US$30 a barrel. The immediate effect of declining oil prices is to shrink the revenue of oil companies like KazMunayGas and related industries, generating a ripple effect that is reflected in lower revenues for Samruk-Kazyna and diminished GDP growth for Kazakhstan (Table 2), with a clearly visible correlation between Brent crude price, and key economic and financial indicators (Figure 3). The practical effect is that unlike Temasek, Samruk-Kazyna has been stagnating since oil prices began falling in 2014.

–

| Year | Brent Crude Price (USD per barrel) | Kazakhstan GDP Growth (per annum) | Samruk-Kazyna Annual Revenue (billion KZT) | KazMunayGas Annual Revenue (billion KZT) |

| 2007 | 60.00 | 8.90% | 487 | |

| 2008 | 102.95 | 3.30% | 2874 | 605 |

| 2009 | 46.86 | 1.20% | 2912 | 485 |

| 2010 | 79.70 | 7.30% | 3609 | 609 |

| 2011 | 98.00 | 7.50% | 4204 | 834 |

| 2012 | 102.99 | 5.00% | 4731 | 899 |

| 2013 | 100.58 | 5.80% | 5031 | 817 |

| 2014 | 103.90 | 4.10% | 2971 | 846 |

| 2015 | 48.50 | 1.20% | 3091 | 530 |

| 2016 | 28.50 | 0.10% | 487 |

Table 2: Comparison of year-on-year GDP growth and annual revenue of Samruk-Kazyna & KazMunayGas vis-à-vis Brent crude price from 2007-2016 (Agency of Statistics of the Republic of Kazakhstan, 2016)(Samruk-Kazyna National Welfare Fund, 2015)(KazMunayGas, 2015)

–

Figure 3: Graph of indices of GDP growth, Brent crude price, and revenue of Samruk-Kazyna and KazMunayGas from 2007-2016 (data obtained from Table 1)

–

Yet, falling oil prices can only partially explain Samruk-Kazyna’s stagnation – the organisation is plagued with bureaucracy, nepotism and inefficiency. Low salaries and poor employee welfare created a gulf between management and employees, triggering a riot and massacre in the KazMunayGas-controlled town of Zhanozen in December 2011. In 2013, the organisation and its subsidiaries reportedly engaged 350,000 employees with 650,000 more affiliated employees (Samruk-Kazyna Press Centre, 2013), indicating a bloated and inefficient human resource policy. This led to the firm announcing its decision in 2013 to replace 30% of its management staff across all subsidiaries, enlisting foreign experts to pass on best practices in order to remedy the rampant inefficiency(Konyrov, 2013).In 2015, it emerged that the 6 members of the executive body of Samruk-Kazyna received combined bonuses totalling US$1.9mln in 2014 alone (Urazova, 2015), in a country where median annual salaries are approximately US$5,000.In contrast, Temasek Holdings maintains lean operations – it has a payroll of only 582 employees, and commits to leaving day-to-day management to the subsidiary companies; involving itself only to ensure sound corporate governance (Temasek Holdings, 2016).

In 2013, Samruk-Kazyna conducted a benchmark exercise headed by McKinsey & Company, which revealed that the return on equity and assets of the company was significantly lower than that of other similar sovereign wealth funds(Shukuyev, 2015). This prompted the launch of a large-scale transformation of the subsidiary operations based on best practices from Temasek Holdings and Malaysian sovereign wealth fund Khazanah Nasional Berhad, focussing on restructuring the portfolio to maximise value, and process-flow maximisation programs to improve human resource conditions. In 2014, Nazarbayev openly ordered Samruk-Kazyna to privatise half of its assets, and in April 2014, Samruk-Kazyna released a statement that it would release 209 of its 599 companies for private ownership(Jafarova, 2014). By 2015, the fund had sold off 36 assets totalling 49bn KZT, with a comprehensive privatisation plan aiming to sell another 783 public assets, including 217 assets owned directly by the Samruk-Kazyna group by 2020(Samruk-Kazyna National Welfare Fund, 2015). Crucially, the fund encouraged foreign acquisition of its assets, and announced its own desire to accelerate acquisition of foreign assets, and engage in joint ventures with foreign firms. The company announced there would be ‘no sacred cows’ in the privatisation drive – downstream, logistics, mining, transportation and even energy industries would be available for external acquisition(Gizitdinov, 2015).

Unfortunately, encouraging investors to acquire nationally critical industries has proved to be an uphill struggle. In 2013, Samruk-Kazyna began calling for buyers for the three banks it had acquired in 2009, drawing a lukewarm response. The banks were eventually sold to two individual businessmen, (rather than being acquired by larger, better-connected banks like Halyk Bank) for approximately 200bn KZT, compared to the nearly 332bn KZT injections made by Samruk Kazyna into the same banks(Interfax-Kazakhstan, 2014).Rumours have also surfaced that the government of Kazakhstan had already begun buying back minority shareholdings in privatised companies in an effort to curtail the influence of independent directors(Bisenov, 2016). The veracity of these rumours is irrelevant, only that the reputation of the privatisation programme has reached a point where investors perceive significant risks, and mistrust both government interference and the firm’s own corporate governance record.

This is not to say that Samruk-Kazyna is poisonous. In fact, while Standard & Poor lowered the credit rating of the firm to ‘BBB-/A-3’ from ‘BBB/A-2’ with a negative outlook, it remains a reputable investor, and a medium-grade investment. Samruk-Kazyna continues to cooperate actively with the Government of Kazakhstan, owning substantial assets in industries capable of fuelling the growing global demand for ores, oil, and other commodities. The continued enactment of the Kazakhstan 2050 plan to correct Kazakhstan’s macroeconomic deficiencies, coupled with the leviathan, ambitious One Belt-One Road plan launched by China and partnered by Kazakhstan’s own Nurly Zhol plan provides Samruk-Kazyna with unprecedented opportunities to become profitable once again.

Effective Governance

Singapore can claim to possess the best civil service in the world, ranked 1st in the 2014 World Bank’s Government Effectiveness and Regulatory Quality Indices. It comprises of a corps of 80,000 civil service officers acting independently from elected officials, many headhunted at the age of 18 by the technocratic Public Service Commission (PSC) and exposed to rigorous interviews and meritocratic selection processes before being sent on government scholarships to prestigious universities in Singapore and abroad. Of these, an elite cadre of approximately 200 officers form the Administrative Service, focussing on the formulation and evaluation of policy rather than its execution. Singapore’s civil service is a human resource pipe-dream – high salaries tagged to top positions in the private sector discourage corruption and attract the brightest talents, a Civil Service College builds strategic capacity, while staff-training opportunities are abound both locally and abroad. Civil services from Abu Dhabi to China have professed intentions to emulate the island-state, but Kazakhstan’s dedication to pursuing the Singapore model of civil service is perhaps the most notable.

On 22 May 2015, Nazarbayev announced a momentuous document: 100 Concrete Steps for Five Institutional Reforms (summarised in Table 4). The document is a highly specific set of government policies, which has been described by the former Russian finance minister and head of Russia’s Sberbank, Herman Gref, as “the Singapore government program”(Sputnik News, 2015). Yet, the contents of the program itself are nothing new, and Kazakhstan has been consistently attempting to emulate Singaporean policy for some time.

| Institutional Reform | Summary of Steps |

| Development of a Professional Civil Service | Creation of a meritocratic recruitment and evaluation system |

| Transition to performance-based renumeration | |

| Restrictions on the accumulation of wealth for civil servants | |

| Creation of anti-corruption legislation and institutions | |

| Ensuring the Rule of Law | Creation of strict recruitment and evaluation system for judiciary |

| Expansion of legal statutes | |

| Encouragement of transparency in judicial proceedings | |

| Creation of new Councils and boards to oversee specific proceedings | |

| Electronification of legal proceedings | |

| Industrialisation and Economic Growth | Implementation of land use reforms |

| Restructuring of tax regimes | |

| Attraction of international investors into strategic sectors | |

| Reorganisation of education to focus on strategic sectors | |

| Liberalisation of labour relations | |

| Drawing down of welfare policies to focus on skills upgrading | |

| Identity and Unity | Development of tourist industry |

| Establishment of information society and e-government | |

| Establishing an Accountable State | Creation of an accounts committee to audit and assess public service |

| Integration of all public services into online portal | |

| Creating results-oriented state culture | |

| Empowerment of local government to formulate policy |

Table 4: Summary of 100 Concrete Steps for Five Institutional Reforms (most relevant sections in bold letters)

–

Kazakhstan inherited the legendarily unwieldy bureaucracy of the Soviet Union, and is plagued by corruption (126/175 on Corruption Perceptions Index) and inefficiency (96/209 on World Bank Government Effectiveness Index). To combat this and under issues, Kazakh officials, including the Prime Minister, have studied Singapore’s public policy under the auspices of the Lee Kuan Yew School of Public Policy in Singapore(Mahbubani, 2015). Under Strategy Kazakhstan 2050, the Government committed to the establishment of a professional and meritocratic civil service. It began by reducing the number of political appointments by 80 percent to encourage transparency and discourage the rampant nepotism that had pervaded the political and social culture of Kazakhstan (Organisation of Economically Developed Countries, 2014). On 23 November 2015, the Government ratified the Law on Civil Service, mandating, inter alia, that government employees would only be hired at entry-level positions and work their way up meritocratically (О государственной службе Республики Казахстан, 2015). This and other initiatives represent concrete steps taken by Kazakhstan to bring the country in line with best practices of the best civil services in the world.

In 2004, the Government of Kazakhstan launched its e-government portal, which remained mostly stagnant such that it ranked 98th on the World Bank’s e-Participation Index in 2008. Then it exploded all at once, launching platforms to access electronic databases for everything from real estate to birth records, payment portals for taxes and school fees, and even creating APIs for mobile access to the e-government services. By 2012, Kazakhstan was ranked 2nd in the world, on par with Singapore. Apart from reducing bureaucracy, the e-government service has also been hailed for its role in reducing corruption, reducing the available avenues for illegal renumeration and bribery. However, in displacing the vertical hierarchy of Kazakh bureaucracy and placing limits on the traditional patronage system, the e-government system’s greatest challenge comes from the embattled public service infrastructure(Janenova, 2016). After an eight-year opposition from the traffic police, drivers’ licenses were electronified in 2012; and the launch of the electronic filing system (mirroring Singapore’s ubiquitous e-Litigation system) in 2015 is still limited to statements of claims and appeals.

In 2013, the Government of Kazakhstan launched Administrative Corps A, a cadre of managerial positions at the highest levels of regional and state government, including city mayors, executive secretaries and chiefs of staff, intended to mirror Singapore’s Administrative Service. Unlike Singapore, Kazakhstan’s strong tribalism and regionalism make local government necessary, and members of Administrative Corps A are expected to formulate semi-autonomous policy decisions. The selection process is rigorous – candidates are subjected to multiple examinations and interviews, and are expected to bear personal recommendations from leading members of the public and private sector(Central Communications Service of the Ministry of Information and Communications of the Republic of Kazakhstan, 2013). This initiative will displace the traditional client-patron networks which used to determine local and national officials, though the personal recommendations stipulation continues to provide a barrier to systemic equality.

Since 1993, the Government of Kazakhstan has funded the Bolashak Scholarship, an all-expenses paid scholarship to top universities locally and abroad with a five-year bond upon return. Unlike Singapore’s PSC Scholarships, Bolashak scholars are preponderantly bonded to private companies rather than the civil service. In this aspect, the Bolashak is more similar to the Singapore-Industry Scholarship (SGIS), a government supported initiative to provide talent to strategic sectors. The Bolashak scholarships has boasted over 12,000 scholars since its inception mostly sent to the UK or the USA, much like Singapore. In recent years, the program has seen a descaling effort, with undergraduate scholarships cut in 2011, and massive slashes to overseas scholarships in favour of encouraging scholars at the nascent Nazarbayev University (Wikileaks, 2008).

Kazakhstan’s challenges to the implementation of a professional civil service and tenets of effective governance are primarily systemic. A culture of nepotism and corruption within the government has created an undercurrent of indolence that provides inertia to any efforts aimed at improving the situation. To break the impasse created by entrenched members of the bureaucracy, Kazakhstan must look elsewhere, as Singapore has not faced the same issue in recent years. It is fortunate that Nazarbayev is a political juggernaut capable of dictating and enforcing government direction by virtue of his unchallenged personal and political influence.

Healthcare

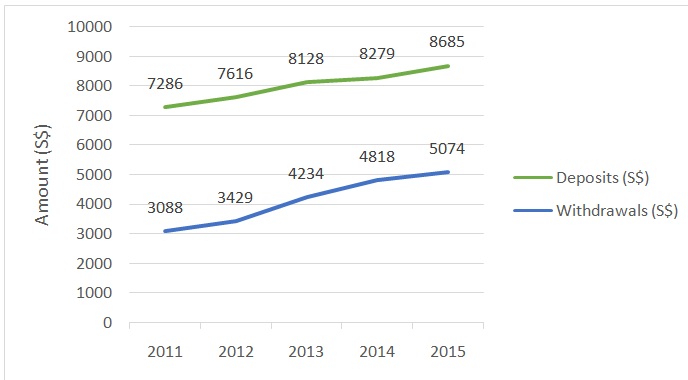

Singapore’s healthcare system is known for its affordability and refusal to provide free healthcare across all income groups. Instead, Singapore relies on compulsory savings, means-tested subsidised healthcare rates and price controls. In the 2015 Health Outcomes Ranking by The Economist Intelligence Unit, Singapore placed 2nd in the world, remarkable since government spending only accounted for 41.7% of average healthcare expenditure, making it the 33rd smallest spender, with an average government healthcare expenditure of US$1,100 per capita, or 1.9 percent of GDP. A major part of Singapore’s success can be attributed to the Central Provident Fund (CPF), a compulsory savings plan where 37 percent of employer salaries (20 percent by employee, 17 percent by employer; 2016 rates) are assigned into accounts from which only authorised payments for housing and education (Ordinary account), medical expenses (Medisave), or retirement (Special account) may be used. 8-10.5 percent of monthly salaries are deposited into the Medisave account.Indeed, the median CPF balance upon retirement is S$126,000, a number which has been growing consistently (see Figure 5), with a median Medisave account of S$24,000 in 2016.CPF savings are invested into Special Singapore Government Securities, which has the two-fold effect of being a highly secure triple-A government bond, and also effectively constituting a massive public loan to Singapore’s reserves (sums raised from sale of government securities may not be used as government expenditure but are instead managed as long-term investments by the Government of Singapore Investment Corporation (GIC)).

–

Figure 5: Graph of mean annual deposits and withdrawals per capita into CPF account (Central Provident Fund, 2015)

–

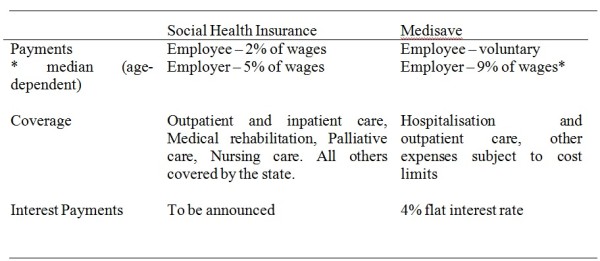

Kazakhstan faces an aging population issue, with 7.1 percent of its population aged 65 and above; compared to Singapore with 10.5 percent bringing with it the associated problems of rising per capita healthcare costs and increasing dependency ratios. In light of this, retirement planning is managed by a 10 percent wage payment to the Single Pension Fund (SPF), which pays out a fixed-rate upon retirement. In 2015, Kazakhstan announced the creation of a Social Health Insurance Fund (SHIF). Employees would be required to contribute two percent of wages, and employers five percent, creating a centralised system for the utility of public healthcare services. This would provide a much-needed injection of funds into Kazakhstan’s creaking national healthcare system, and hopefully improve the quality and availability of medical services. The SHIF has already attracted the support of the World Bank, which extended a US$80 million loan to Kazakhstan through the International Bank of Reconstruction and Development (IBRD) in 2016 for its implementation (World Bank, 2016).

Table 6: Key similarities and differences between the Social Health Insurance and Medisave programmes

Table 6: Key similarities and differences between the Social Health Insurance and Medisave programmes

–

SHIF suffers from the ill-reputation surrounding its predecessor, the Mandatory Health Insurance (MHI) Fund, which was launched in 1996 and collapsed under heaving bureaucracy and inefficiency in 1998. The World Bank report on the SHIF specified population fatigue for government-led health insurance policies, which may lead to mistrust and low levels of adoption.

Kazakhstan’s macroeconomic indicators provide some cause for concern regarding the programme. Firstly, Kazakhstan’s interest rates of 13 percent are significantly higher than Singapore’s interest rates of 1.5 percent, which will require similar levels of interest rates on sums in the SHIF. Secondly, Kazakhstan has faced steadily declining growth rates since 2010 on the back of falling oil prices, and the increase in labour costs to employers comes at a time when investors are already debating their options in other parts of Central Asia. Nonetheless, Kazakhstan’s low unemployment rates of 5.10 percent in 2016 suggest that it still has the capacity to absorb higher labour costs without significant impact to the economy.

Conclusion

While Kazakhstan has openly stated that many of its policies are influenced by Singaporean policies, the details of how policymakers adapted Singaporean policies for Kazakh society is understandably not in public domain. However, by assessing the similarities and differences, it is clear that Singapore policies have been of use to Kazakhstan’s development, particularly in recent years.

Due to a shared background of conservative Asian values and (generally agreed though controversial) benevolent authoritarian governments, both countries have the enviable ability to enact long-term, Whole-of-Government policies. It is this capacity to absorb political costs in order to pursue development goals that gives Kazakhstan the ability to emulate Singapore.

However, Singapore has some key advantages that Kazakhstan undoubtedly does not enjoy. Chief among them is Singapore’s diversified economy that is not reliant on any particular sector or commodity, but rather on international trade as a whole. Kazakhstan’s vulnerability to oil shocks undermines its ability to support sustained policies in the manner of Singapore. In addition, Singapore’s compact and highly urbanised population responds to policies with significantly less lag time, while Kazakhstan still has rural and even tribal populations across its wide expanse. On top of this, an established culture of entrepreneurship and business provides the basis for a productive business culture, compared to the Soviet legacies entrenched in Kazakhstan.

As a result of the significant differences, Kazakhstan has recognised that Singapore does not hold the answers for all its problems. At the VIII Astana Economic Forum in May 2015, Nazarbayev announced that Astana would be rebuilt as a “new Dubai”, leveraging on Dubai’s legislative and economic experiences to mould Astana into an international hub for petrochemical-related finance. Dubai’s successful transition from an almost exclusively oil-producing economy into a service-based economy may prove to be a better role model for Kazakhstan in some domains.

–

References

Agency of Statistics of the Republic of Kazakhstan. (2016). The official statistical information. Retrieved from Ministry of National Economy of the Republic of Kazakhstan Committee on Statistics: http://www.stat.gov.kz/faces/publicationsPage/publicationsOper?_adf.ctrl-state=c9x5a2tz3_34&lang=en&_afrLoop=3753629369057408&visiblescreen=no&page_id=publicationsOper

Baker & McKenzie. (2009, February 4). Baker & McKenzie – CIS, Limited. Retrieved from Baker & McKenzie: http://www.bakermckenzie.co.jp/e/material/dl/supportingyourbusiness/newsletter/emi/Feb4.pdf

Baudarbek-Kozhatayev, Y. (2013, April 22). 20th Anniversay of Diplomatic Relations Between Kazakhstan and Singapore. The Business Times, p. 20.

Bisenov, N. (2016, May 30). Kazakhstan’s privatisation programme faces “strategic” challenge. Intellinews.

Central Communications Service of the Ministry of Information and Communications of the Republic of Kazakhstan. (2013, April 3). SELECTION OF CANDIDATES TO CORPS A BEGINS IN KAZAKHSTAN. Retrieved from Ortcom.kz: http://ortcom.kz/en/news/selection-of-candidates-to-corps-a-begins-in-kazakhstan.1069

Central Provident Fund. (2015). CPF Annual Report 2015. Singapore: Central Provident Fund.

Gizitdinov, N. (2015, October 30). Kazakh Sovereign Fund Sees No `Sacred Cows’ for Privatization. Bloomberg News.

Interfax-Kazakhstan. (2014, February 27). Samruk-Kazyna sells its stakes in four banks at a loss. Interfax-Kazakhstan.

Jafarova, A. (2014, April 17). Kazakh Samruk-Kazyna to sell over 200 companies. Azernews. Retrieved from http://www.azernews.az/region/66168.html

Janenova, S. (2016). PUBLIC SERVICE INNOVATIONS IN KAZAKHSTAN. Astana.

KazMunayGas. (2015). Annual Report 2015. KazMunayGas Annual Report.

Konyrov, B. (2013, May 22). Samruk-Kazyna to replace 30% of its managing directors. Tengrinews.

Mahbubani, K. (2015, July 25). The unusual partnership of Singapore, Kazakhstan. The Straits Times.

Nazarbayev, N. (2006). The Kazakhstan Way. (Russian, Trans.) Karaganda: Stacey International. Retrieved September 22, 2016, from http://personal.akorda.kz/images/file/36fe1739f2c39ca6d78b31f6e40d0a9c.pdf

Nazarbayev, N. (2015). The 100 concrete steps set out by President Nursultan Nazarbayev to implement the five institutional reforms. Astana: Government of Kazakhstan.

Organisation of Economically Developed Countries. (2014). OECD Public Governance Reviews Kazakhstan: Review of the Central Administration. Paris: OECD Publishing.

Samruk-Kazyna National Welfare Fund. (2010). Annual Report 2010. Samruk-Kazyna Annual Reports.

Samruk-Kazyna National Welfare Fund. (2012). Annual Report 2012. Samruk-Kazyna Annual Reports.

Samruk-Kazyna National Welfare Fund. (2015). Annual Report 2015. Samruk-Kazyna Annual Reports.

Samruk-Kazyna Press Centre. (2013). Глава АО «Самрук-Қазына» Умирзак Шукеев вручил государственные награды сотрудникам группы компаний Фонда. Astana: Samruk-Kazyna Press Centre.

Shukuyev, U. (2015). Umirzak Shukuyev. Retrieved from Invest in Kazakhstan 2015: http://kazakhstan.newsdeskmedia.com/Images/Upload/Kazakhstan_2015/PDFs/Umirzak_Shukeyev.pdf

Sputnik News. (2015, May 22). Kazakhstan Unveils ‘Singapore’-Like Government Reform Plan. Sputnik News.

Temasek Holdings. (2016). Temasek Review 2016. Temasek Review. Retrieved September 22, 2016, from http://www.temasek.com.sg/documents/download/downloads/20160706235822/TR2016_Singles.pdf

Temirbank. (2015). Financial Statements 2015 (Russian). Temirbank Financial Statements. Retrieved from http://www.kase.kz/files/emitters/TEBN/tebnf6_2012_rus.PDF

Urazova, D. (2015, January 19). Kazakh budget revised amidst dropping oil prices. Tengrinews.

Urazova, D. (2015, September 4). What are Samruk Kazyna board members paid. Tengrinews.

Wikileaks. (2008). 08ASTANA2263_a. Astana: Wikileaks.

World Bank. (2016). Social Health Insurance Project: Improving Access, Quality, Efficiency and Financial Protection. Paris: World Bank.

World Bank. (2016, April 27). World Bank to Support the Improvement of Health Service Delivery in Kazakhstan. Retrieved from World Bank: http://www.worldbank.org/en/news/press-release/2016/04/27/world-bank-to-support-the-improvement-of-health-service-delivery-in-kazakhstan

О государственной службе Республики Казахстан. (2015). О государственной службе Республики Казахстан.Astana.

(Boh Ze Kai is a Project Intern with Mantraya. This Special Report is published as part of Mantraya.org’s “Borderlands” and “Regional Economic Cooperation and Connectivity in South Asia” projects.)

To Read previous Special Reports, CLICK HERE